florida estate tax exemption 2021

Will provide over 168 million in savings for families and businesses. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the.

Florida Inheritance Tax Beginner S Guide Alper Law

The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year.

. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Governor DeSantis Signs Floridas Tax Cut Package. There is no gift tax in Florida.

The tax cuts and jobs act raised the lifetime gift and estate tax exemption to 117 million for 2021 and 1206. 2021 Florida Sales Tax Commercial Rent December 30 2020. In Vermont the estate tax exemption has increased from 425 million in 2020 to 5 million for 2021 and thereafter the Vermont exemption amount had been 275 million.

Homestead Exemption Save Our Homes Assessment Limitation and Portability Transfer. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. Ad From Fisher Investments 40 years managing money and helping thousands of families.

Even though Florida doesnt have an estate tax you might still owe the federal estate tax which kicks in at 117 million for 2021. The gift tax annual exclusion remained the same between 2019 and 2021. But once you begin providing gifts worth.

What this means is that. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. When someone owns property and makes it his or her permanent residence or the permanent.

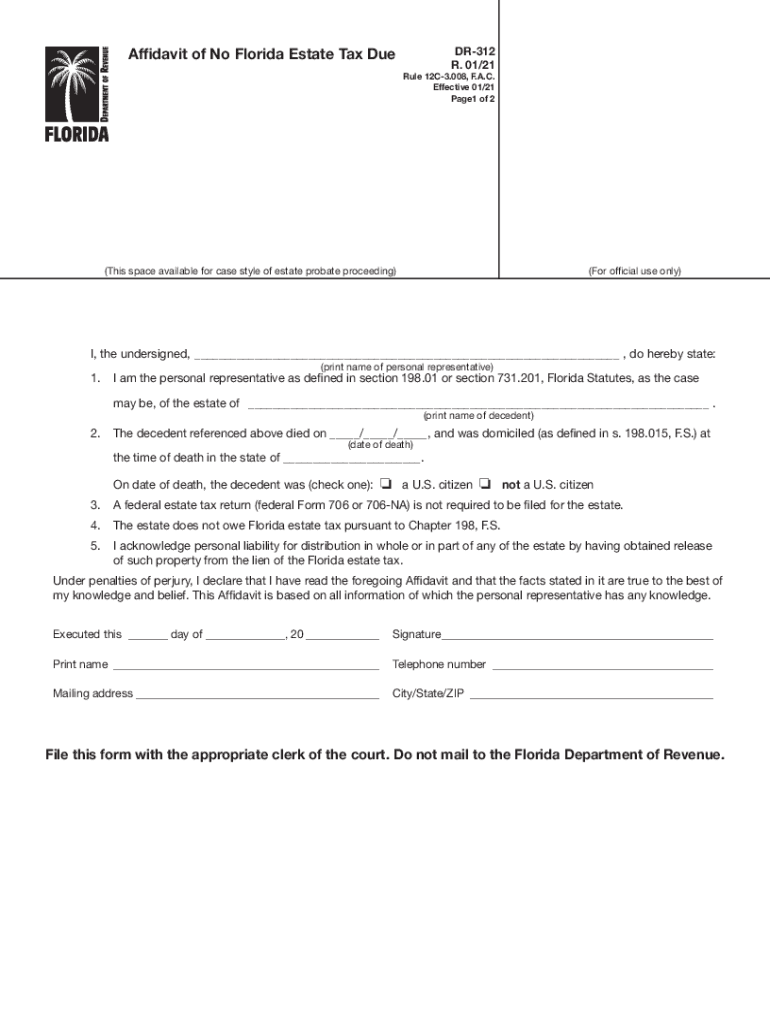

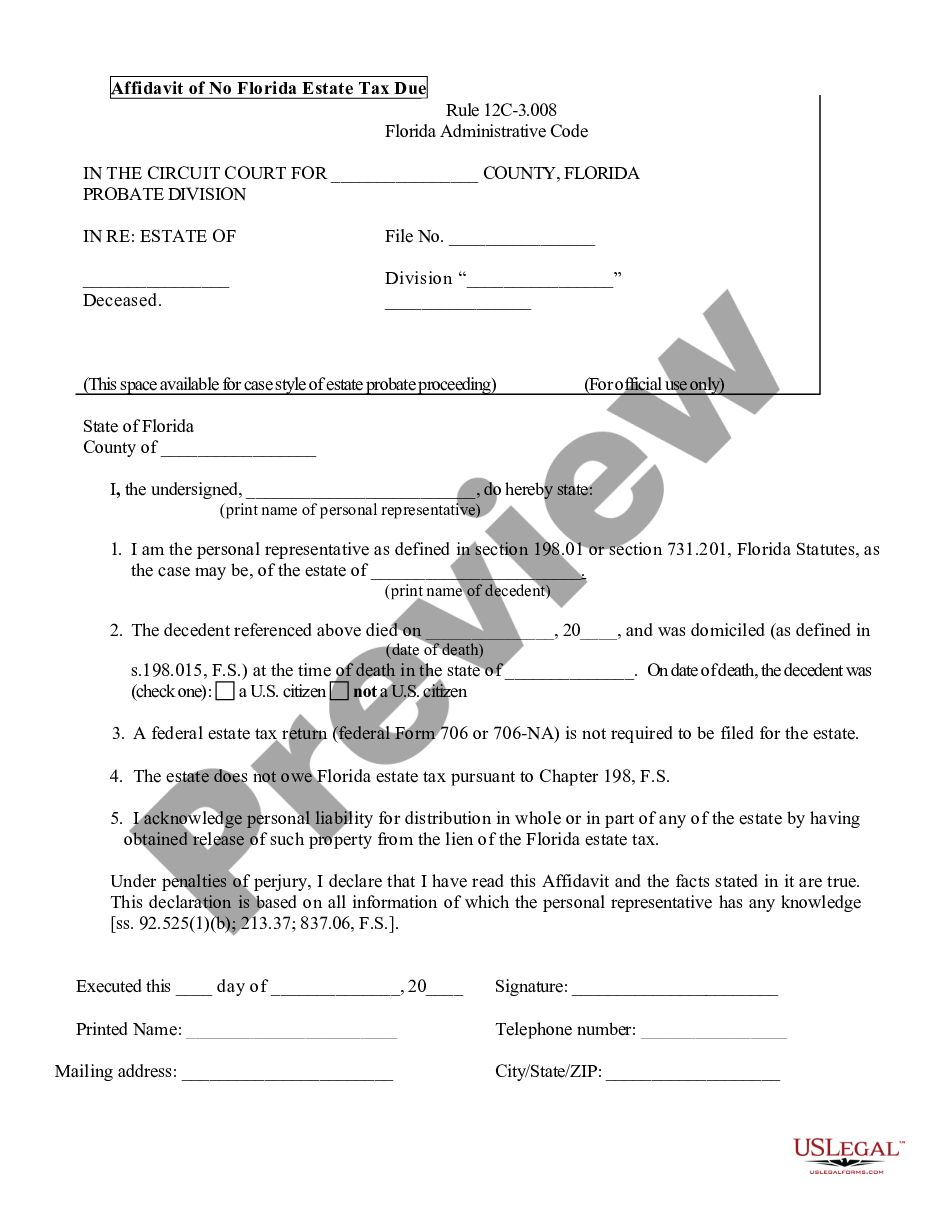

Florida used to have a gift tax but it was repealed in 2004. 813 286-6563 Cell Phone. No Florida estate tax is due for decedents who died on or after January 1 2005.

Presently the tax exemptions are set at 11700000 per person an increase from 2020s exemption of 11580000. Still individuals living in Florida are subject to the Federal gift tax rules. An individuals leftover estate tax exemption may be transferred to the surviving spouse after the first.

2022 Annual Gift Tax Exclusion - increased to 16000 from 15000. Florida estate tax exemption 2021 Thursday March 10 2022 Edit. Couple A in 2020 makes a gift transfer of 20MM leaving them with with 316MM in their TCJA 2020 estate tax exclusions.

Given that Florida has around a 2 average tax rate that means a homeowner with 500000 in portability will see a tax bill about 10000 a year lower than it would be without it. In 2021 the government changes the estate tax. Even if youre a US.

As a result of recent tax law changes only those who die in 2019 with estates equal to or greater than 114 million must pay the federal estate tax. If your estate is worth less than this youll need to pay the federal income tax as well. If youre a Florida resident and the total.

Extending the expiration date of the sales tax exemption for data center. The amount of the estate tax exemption for 2022. Bob Hodge Realtor 500 N Westshore Blvd Ste 850 Tampa FL 33609 Office Phone.

On May 21 2021 in News Releases by Staff. Citizen the Florida estate tax exemption amount is still 114 million. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020.

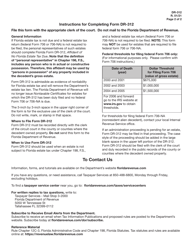

Florida Estate Tax Rules On Estate Inheritance Taxes Fl Dor Dr 312 2021 2022 Fill Out Tax Template Online. Presently the tax exemptions are set at 11700000 per person an. Good news but makes it a little harder to do the math for mutliple gifts in your head.

813 245-1157 Real estate agents affiliated with Coldwell Banker. For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. Proposal 1 A reduction in exemptions.

Starting in 2022 the exclusion amount will increase annually based. Federal Estate Tax. The Tax Cuts and Jobs Act raised the lifetime gift and estate tax exemption to 117 million for 2021 and 1206 million in 2022.

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Florida Inheritance Tax Beginner S Guide Alper Law

![]()

Florida Inheritance Tax Beginner S Guide Alper Law

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

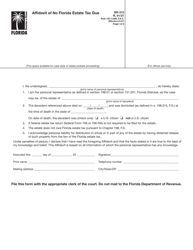

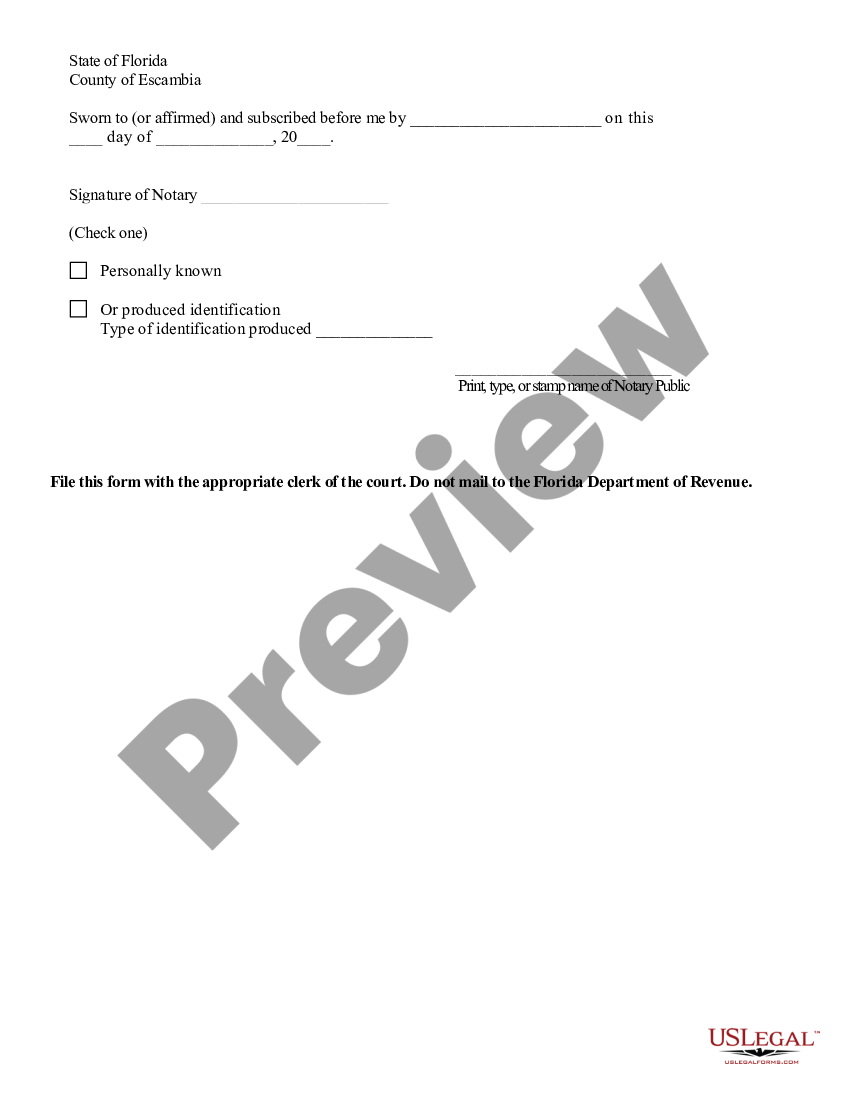

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Florida Estate Planning Complete Overview Alper Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Attorney For Federal Estate Taxes Karp Law Firm

Florida Estate Tax Rules On Estate Inheritance Taxes

Affidavit Of No Florida Estate Tax Due Florida Estate Us Legal Forms

Fl Dor Dr 312 2021 2022 Fill Out Tax Template Online Us Legal Forms

Florida Estate Planning Guide Everything You Need To Know

Affidavit Of No Florida Estate Tax Due Florida Estate Us Legal Forms

Docreviewers Earn More Money Estate Planning How To Plan

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Affidavit Of No Florida Estate Tax Due Florida Estate Us Legal Forms

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller